Are you on the fence about jumping into the crazy, hot Vancouver market? Second thoughts?

Reasons to get off it.

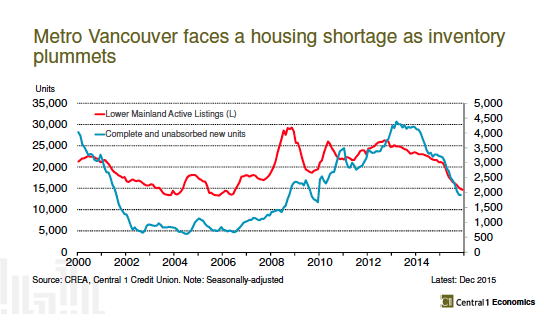

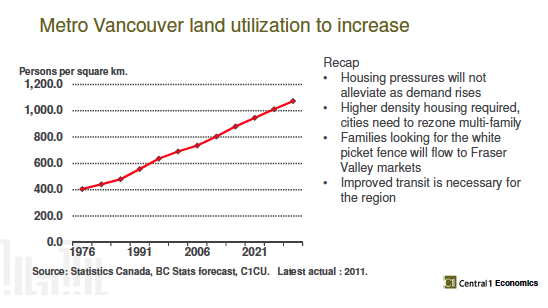

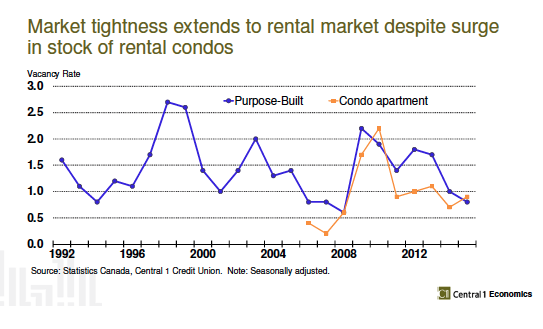

One of the major downsides of waiting is not being able to afford the property you want in the future. Many of the people who sat on the fence about buying in the Greater Vancouver area can no longer afford the home they wanted. The biggest downfall to waiting is the tens of thousands of dollars they’ve spent on rent. There’s no reason to think that this will change any time soon – so the longer you wait, the further you get left behind, and you’ll end up paying off your landlord’s mortgage for the rest of your life instead of your own. What’s more, rental prices in Vancouver are skyrocketing, with rental prices going through the roof, renting is no longer a cheap or secure option. Keep in mind this is all based on not wanting a long commute and hours spent sitting in traffic.

If you buy a home, even in the event of real estate prices plummeting, with the equity you are creating, with the rates remaining low you could still break even on your housing costs when you consider the amount you would have paid every month in rent. The average housing prices go up in Canada by 5.4% and over time the market will go back up again – it’s only a temporary loss of value and is only a problem if you wish to sell before the value has recovered. Another term for this is flipping your property. (The chances of a major crash in B.C., and especially Vancouver, are low according to all the market indicators and economic forecasts.)

Reasons to stay on the pot.

There is only really one situation where it makes more sense to keep renting, and that is if buying would stretch your finances to the point where you wouldn’t be able to deal with an emergency. Losing your job, an unexpected child, or a medical emergency fall into this category. If that’s the case, and there’s definitely no option for you to buy a home that doesn’t stretch your finances, then you should save what you can and wait until you’re more financially stable, and then buy. Owning a home of your own is very satisfying but there are many extra costs such as maintenance fees, taxes, or unexpected maintenance (this is different from normal maintenance, as in special levies or leaky roof, pipe burst etc.). Stretching yourself too thin can be disastrous.

Everyone has a different financial situation, and if you're not confident in your ability to purchase, go to a mortgage broker to go over your budget to fully understand your situation. Your broker can run different scenarios to show how rates, terms and amortization schedules would impact your monthly payment. With the right information you can make a better decision instead of waiting for a crash that may never come, and joining the doomsday sayers in their quest for validation.